Dominion Lending is a mortgage and leasing company with more than 2,000 members offering free expert advice across Canada for all your mortgage needs:

- Residential Mortgages

- Commercial Mortgages

- Equipment Leasing

Mortgage Questions

Renewals & Transfers

Did You Know?

There are absolutely no costs to transfer your mortgage from one Banking Institution to another. No appraisal fees, no legal work and no penalties.

Yet still, mortgage renewals are one of the most neglected decisions made during the life of a mortgage. Many homeowners stay with their existing mortgage lender because they believe it is too time consuming to shop around for a better rate. Or, they may think the offer from their existing bank is the best deal available. This is not true.

Experience shows that most banks offer renewing clients a discount of .25% (whereas we can negotiate up to almost 2% off of posted) off posted rates; as well, negotiating a rate discount with the branch can often be a timely process and will often not lead to the best rate.

If the client does manage to negotiate a better rate, it’s usually a maximum ceiling discount of 1%. This is the maximum the branch allows a mortgage representative to discount any mortgage product. Some special cases are given for clients who have many investments held within the bank. For the most part, however, there are no exceptions made.

All Dominion Lending Centres-Regional Mortgage Group clients are treated with respect, courtesy and privacy. Our best rates are posted and all of our clients are assured the same dedication to finding the best mortgage solution for your needs.

At DLC Regional Mortgage Group, we focus 100% of our time and effort on the mortgage market. This is very crucial when it comes to providing the service and rates that each client deserves.

When your mortgage is nearing renewal (that is, when the term is complete) remember these two significant opportunities to save money:

- Don’t wait for the Bank! Approach your mortgage lending institution months before the renewal date and ask what they can do for you.

- Keep Asking! Be confident to negotiate with your mortgage provider as to what their best rate on your renewal can be. Then, call us and we’ll beat that rate too, and at NO cost to you.

Example:

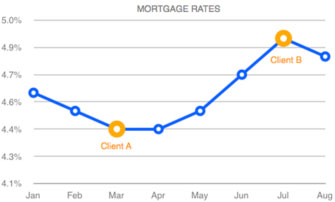

Let’s assume two clients share the same maturity date of July 1, 2012. Client “A” calls DLC Regional Mortgage Group four months prior to the date, enabling us to go to the market and get client “A” the lowest rate possible, guaranteed until July 1, 2012. This costs Client “A” nothing! If rates decrease, Client "A" will benefit and receive the lowest rate in the marketplace, right up to July 1, 2012. If rates increase, Client "A" is protected because they locked in. The new bank pays all the costs associated with mortgage transfers. Client "A" received a rate of 3.29% on March 1, 2012.

Client “B” waits until their current lender notifies them in the mail that renewal time is near. (Typically about 15-20 days prior to the maturity date.) The Banks are very clever and know how to ensure their clients resign at their rate.

They know 15 days is not enough time to properly research the market and comparison shop.

They know that most clients are unaware that companies like DLC Regional Mortgage Group exist, because 90% of their clients do not transfer their mortgages.

They know that 75% of clients do not negotiate off the posted rates sent in the renewal agreement. (That means that 75% of their clients are paying rates as high as 1.5% above the wholesale market!)

When client “B” receives the renewal notice on June 15, 2012, the best 5 year rate is 5.19%, or 1.9% higher than the rate we secured for Client “A”.

* This rate would only be available if they negotiated very well.

Over a five-year term with a typical mortgage amount of $200,000, a difference of 1.9% in the 5 year rate will save Client “A” $16,000.00

.

With this knowledge you can protect yourself and save money. Call us anytime and speak to one of our Mortgage Specialists about all of your renewals / transfers needs at 866-343-1125.

Call To Action

For more information on any program you may be interested in please either email us at

This email address is being protected from spambots. You need JavaScript enabled to view it.

or call 403-343-1125 to set up an appointment with an agent.

Renewals & Transfers

Did You Know?

There are absolutely no costs to transfer your mortgage from one Banking Institution to another. No appraisal fees, no legal work and no penalties.

Yet still, mortgage renewals are one of the most neglected decisions made during the life of a mortgage. Many homeowners stay with their existing mortgage lender because they believe it is too time consuming to shop around for a better rate. Or, they may think the offer from their existing bank is the best deal available. This is not true.

Experience shows that most banks offer renewing clients a discount of .25% (whereas we can negotiate up to almost 2% off of posted) off posted rates; as well, negotiating a rate discount with the branch can often be a timely process and will often not lead to the best rate.

If the client does manage to negotiate a better rate, it’s usually a maximum ceiling discount of 1%. This is the maximum the branch allows a mortgage representative to discount any mortgage product. Some special cases are given for clients who have many investments held within the bank. For the most part, however, there are no exceptions made.

All Dominion Lending Centres-Regional Mortgage Group clients are treated with respect, courtesy and privacy. Our best rates are posted and all of our clients are assured the same dedication to finding the best mortgage solution for your needs.

At DLC Regional Mortgage Group, we focus 100% of our time and effort on the mortgage market. This is very crucial when it comes to providing the service and rates that each client deserves.

When your mortgage is nearing renewal (that is, when the term is complete) remember these two significant opportunities to save money:

- Don’t wait for the Bank! Approach your mortgage lending institution months before the renewal date and ask what they can do for you.

- Keep Asking! Be confident to negotiate with your mortgage provider as to what their best rate on your renewal can be. Then, call us and we’ll beat that rate too, and at NO cost to you.

Example:

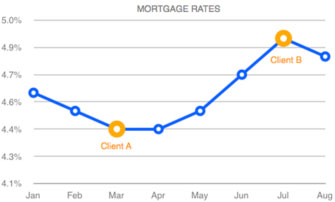

Let’s assume two clients share the same maturity date of July 1, 2012. Client “A” calls DLC Regional Mortgage Group four months prior to the date, enabling us to go to the market and get client “A” the lowest rate possible, guaranteed until July 1, 2012. This costs Client “A” nothing! If rates decrease, Client "A" will benefit and receive the lowest rate in the marketplace, right up to July 1, 2012. If rates increase, Client "A" is protected because they locked in. The new bank pays all the costs associated with mortgage transfers. Client "A" received a rate of 3.29% on March 1, 2012.

Client “B” waits until their current lender notifies them in the mail that renewal time is near. (Typically about 15-20 days prior to the maturity date.) The Banks are very clever and know how to ensure their clients resign at their rate.

They know 15 days is not enough time to properly research the market and comparison shop.

They know that most clients are unaware that companies like DLC Regional Mortgage Group exist, because 90% of their clients do not transfer their mortgages.

They know that 75% of clients do not negotiate off the posted rates sent in the renewal agreement. (That means that 75% of their clients are paying rates as high as 1.5% above the wholesale market!)

When client “B” receives the renewal notice on June 15, 2012, the best 5 year rate is 5.19%, or 1.9% higher than the rate we secured for Client “A”.

* This rate would only be available if they negotiated very well.

Over a five-year term with a typical mortgage amount of $200,000, a difference of 1.9% in the 5 year rate will save Client “A” $16,000.00 .

With this knowledge you can protect yourself and save money. Call us anytime and speak to one of our Mortgage Specialists about all of your renewals / transfers needs at 866-343-1125.